Do You Have to Pay Back Financial Aid?

This post was written by Tiffany Knight and co-authored by Emily Dobson especially for College Essay Guy.

Tiffany Knight

-

University Advisor at UWC ISAK Japan in Nagano, Japan

-

Educator | Advocate | Access Warrior

Emily Dobson

-

EDGE Direcionamento Educacional in Porto Alegre, Brazil

-

Mom | Educator | Executive Board InternationalACAC | Caribbean and Latin America Network Founder | Access Warrior

TABLE OF CONTENTS

- What makes this financial aid guide amazing?

- What costs do I consider before I even start college?

- Cost of applying to college

- College application fees

- Financial aid application fees

- Standardized testing and reporting

- Courier/Postal services

- Document Notarization/Apostille/Legalization/Translation

- Enrollment deposits/Application processing fee

- Visa Applications

- Cost of Attending (COA)

- Creating a budget

- Understanding Estimated Family Contribution (EFC)

- College match/fit and list building

- Common Data set and how to use it

- Non-traditional or alternative pathways

- What are the types of financial documents required?

- CSS profile

- Students demographic information

- Parent information

- Student academic status

- Income and assets of parents and students

- Household information

- Parent expense details

- Supplemental questions

- CSS profile for parent use

- CSS profile dashboard

- CSS profile and IDOC

- Forms and status of submitted documents

- International Student Financial Aid Form (ISFAA)

- Student information

- Parent information

- Financial information

- Asset information

- Expenses

- Expected support/offer

- Special circumstances

- Changes to your financial aid application

- What to do once you're accepted

- A brief guide to analyzing your financial aid award letters

- How to appeal your financial aid offer

- How do I show gratitude for those who made a difference in my college journey?

- What Does that Word Mean? (A Glossary)

What Makes This Financial Aid Guide Amazing?

What follows is a short (well, as short as we could get it) overview of the financial aid process and possibilities for international students, including those with dual U.S. citizenship. We created this guide to help you:

-

See that financial assistance comes from several sources (and you can get it before and during college)

-

Provide context to understand the terminology used

-

Become more familiar with some of the documentation often required to receive aid

-

(Hopefully) feel empowered by this information

Luckily, we had a crew of international student interns helping us out; so if you think this booklet is AMAZING, that's probably a major reason why.

Note: For the purpose of this guide, we will use "college" and "university" interchangeably. A definition is offered for each in the glossary section.

What Does the Cost Breakdown Look Like?

Before getting too deep into the research of what college or university you might want to attend, it's a good idea to understand the total cost of applying and then actually attending a university. This information is best used with the support of a university financial aid office or admission counselor, to help you accurately determine and categorize costs.

Cost of Applying to College

There are a variety of costs to consider even before making your college list. Understanding these costs will help you budget and plan, smartly. Your first step in your college journey? Knowing how to dissect/determine fees in order to create a balanced and viable college list.

College Application Fees

These are fees charged to subsidize the organizational costs of reading and evaluating applications. They are charged in a number of ways:

-

Centralized Application Fee: UC Application (UCLA, UC Irvine)

-

Individual Application Fee: The Common Application form, university-specific application

-

Centralized Fee with Individual Fee: Ontario system, UCAS

Financial Aid Application Fees

In the irony of all ironies, you may have to pay money just to tell universities that you don't have enough money to attend. In order to request financial assistance, many institutions use a common financial aid application called the CSS Profile, which costs between $16-25 USD per school. The CSS Profile acts as a "financial aid calculator form." Found online, the form is filled out with information from federal and bank documents to accurately show how much money students have available to pay for college. When submitted, applicants can be applicable for need-based aid after a college reviews the (true and honest) account of finances.

Standardized Testing and Reporting Fees

If your university list requires tests like the SAT, SAT Subject Tests, ACT, TOEFL, IELTS, or Duolingo English Test, there will be a fee to take the exams. Once you are done testing, if you know the schools to which you will apply, on the day of testing you can choose to send the scores, free of charge, to four colleges and universities—one more reason to start researching and have a balanced college list. If your list is not researched at the time of the tests, score reports will need to be ordered and paid for individually. Pros? Free tests to colleges. The Score Choice option allows students to use scores from the sections they scored highest over multiple test dates. Something to consider? Be ready for the exam(s) after taking ample time to practice; once you decide to send the scores, they are sent and filed by the university. On that note, many colleges are test-optional; to find out which ones are, check out FairTest.org.

If your applications are not electronic, you may have to send materials through the post office. This is the case for many overseas universities.

Note: Make sure you check the deadlines for your schools. Many have rules that state the application paperwork "must be stamped and dated/sent by" a specific deadline.

Document Notarization/Apostille/Legalization/Translation

Some universities might require that your credentials be verified or validated by a legal or government entity. In some cases, it might be necessary for your documents to include an official translation with your documents or even an apostille, which certifies from one country to another that the document has been signed by a notary public.

Enrollment Deposits/College Application Processing Fee

After you have been accepted and decided upon a university, politely tell the others you will not be attending. You will be required to pay a deposit as a sign of commitment. The amount of this deposit varies from school to school and country to country. Even if you are a scholarship recipient, you may be required to pay a small, affordable enrollment fee to show your commitment to the school

Netherland's Portal Studielink →$100 USD

Japan →$2000~$5000 USD

Australia →$90 USD

Once you have been offered and have accepted a place at a university, you will go through the process of obtaining a visa to study for the country wherein you plan to attend university. Visa costs vary by country but can range from $0 to $550 USD. Universities are able to provide guidance with the visa process; contact your admission officer for support.

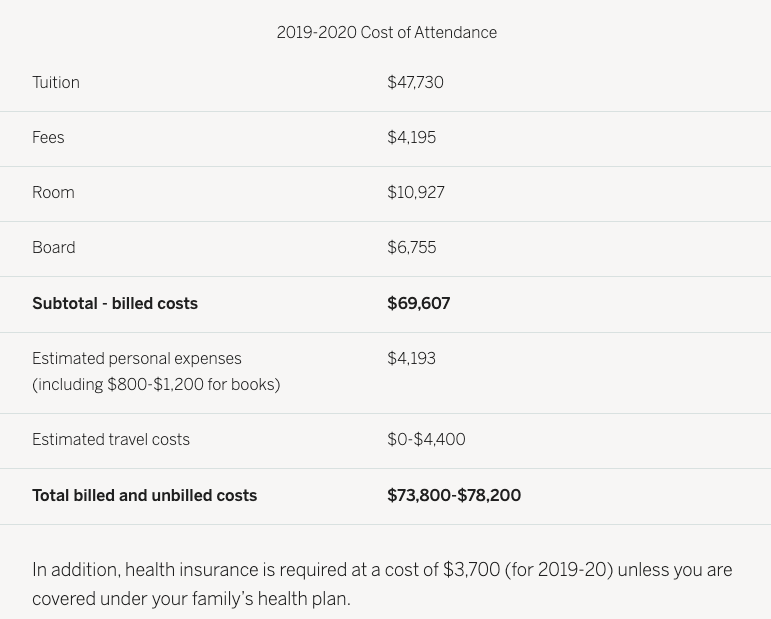

As you are researching to plan for the total cost of attending college, look for a breakdown of fees from the beginning of enrollment and throughout the academic year.

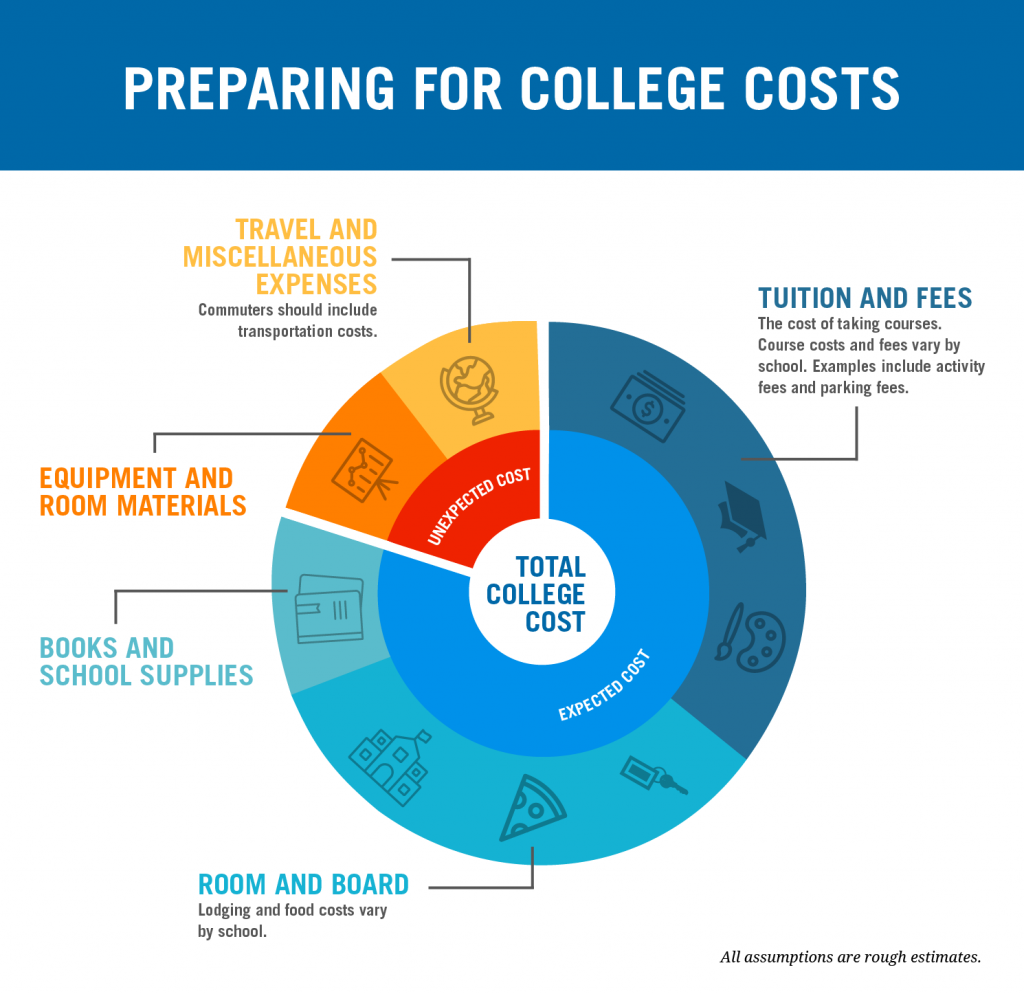

The cost of attendance will generally include:

| Visa (I-20 and other visa fees) | ---- indirect cost (you pay for it) | ||

| Tuition (classes) | ---- direct cost (you pay the university for it) | ||

| Room and Board (living and meal plans) | ---- direct cost | ||

| Health Insurance (mandatory) | ---- indirect | ||

| Additional Fees (varies) | ---- indirect | ||

| Personal Expenses (airfare, books, miscellaneous) | ---- indirect |

The COA can be broken down into two types of costs: direct cost (billed costs) and indirect costs (unbilled costs). Direct or billable costs are the fixed fees that you have to pay to attend college. This will at least include tuition and general fees, but in some cases, it might include room and board (U.S. only). Additionally, when researching the potential cost of a university, consider all the indirect costs associated with attending. This could include a variety of expenses, such as books, personal expenses, and transportation to and from campus.

Calculating indirect cost can be difficult. The type of college or university you select will impact these costs. For example, if you attend a university in the Netherlands, your indirect costs will include room and board in addition to other living and personal expenses. However, in the United States, indirect costs will vary depending on whether your plan is to attend a private college with mandatory residential programs or a community college.

*Mandatory health insurance through the university or approved by the university costs $2,500-$4,000 USD per year. Often, this is not included in the charts due to varying costs and options; universities usually provide links with more information regarding health care.

Tip: Have you searched all over the school website and can't find the cost of attendance? Look at its Common Data Set! Still can't find what you need? Reach out to an admission representative!

Creating a College Application Budget

Research is your biggest advantage in this process, along with knowledgeable adults. You are responsible for establishing your team, and now that you have a clearer understanding of the costs associated with attending college or university, it's time to think about how much you'll be responsible for and how much financial aid you may need.

While some of the fees below can be waived or paid by universities, as a savings goal, it's best to keep all expenses in mind. The following is a list of potential expenses to help you establish savings goals to prepare you for your college adventure. Use the right column to note what expenses you are likely to have and add them up. Don't forget to include an additional 10% of the total as a budget for contingencies (i.e., costs you didn't or couldn't predict).

College Budget Example:

| Category of Expense | Potential Costs | Potential Savings Goal | SAVINGS GOAL |

|---|---|---|---|

| HIGH PRIORITY | |||

| Enrollment Deposits *Enrollment deposits are sometimes waived by universities for students with demonstrated financial need. | Varies USA/CANADA Enrollment Deposit $300 USD Housing Deposit $100 USD UK ASIA | | |

| Visa Fees *U.S. ONLY: The SEVIS fee may be paid by the university for students with demonstrated financial need. | USA SEVIS Fee $350 USD Visa Appointment Fee $160 USD Reciprocity Fees (varies by country) UK | | |

| Legalization of documents | Varies Do research to determine if this cost applies to you! Remember that there may be separate fees for getting documents and having them notarized. Also consider the cost of postal or courier services. | | |

| Health Checks and Vaccinations | Varies Do research to determine which vaccinations you might need! ★ Some university health insurance plans will cover vaccinations once you arrive in the U.S. Ask the university rep for details! | $1,000 USD | |

| Travel to University These expenses will cover transportation from the door of your house to the airport, the flight, and transportation to your university/housing. | Varies | $4,000 USD | |

| SECOND PRIORITY | |||

| Getting Started Expenses Financial aid often includes funding for personal expenses and books, but this may not cover other major expenses, such as a computer, phone, or winter clothes. | Varies What sort of items do you think you'll need to start school? | | |

| Personal Expenses To cover expenses until your first paycheck from work-study is available | Varies | $1,000 USD | |

| Sub-Total | |||

| Emergency Fund (10%) | |||

| TOTAL SAVINGS GOAL | |||

Understanding Estimated Family Contribution (EFC)

The Expected Family Contribution (EFC) is a term often used by U.S. universities to estimate, by analyzing certain documentation, an amount you and/or your family can contribute toward the cost of attending college. This is not a definitive number the family is expected to pay, but rather a starting point for the institutions to build from when creating financial-aid packages.

EFC uses a formula that takes into account taxed and untaxed income, assets, savings, and benefits.

Start with an honest financial inventory. To do that, you should have a conversation with your parents, relatives, potential contributors … anyone who has a financial stake in your education. During this conversation, agree on a realistic annual Estimated Family Contribution (EFC) for each of the four years you will be in college. Remember, your EFC should represent the maximum contribution possible toward your college education, or what your family is able to pay, not what they want to pay.

-

How much can my family contribute to my education? (total contribution, including airfare, personal expenses, health care, etc.)

-

Does this school meet full demonstrated need?

-

Do financial-aid packages cover any indirect costs?

-

Is there a minimum EFC required to attend this college?

-

What effect do merit scholarships have on need-based financial-aid packages?

-

Do financial-aid packages for international students include loans?

My Responsibility: The Search for Fit

The goal of this process is to find the post-secondary pathway that is the best fit for you. Maybe that's going to college to study architecture, or maybe it's taking a gap year, or maybe it's taking a shot at starting your own business. Careful research will help you find the pathway to best match your goals.

To find the best fit, you need to thoughtfully consider what you want and reflect, realistically, of what you are capable of. You also need to know what options are available to you out there in the world. That's where research comes in. EFC limitations should play a major role in guiding initial school search. High EFC affords more options. Low EFC requires more detailed research into the school's admission and aid award policies.

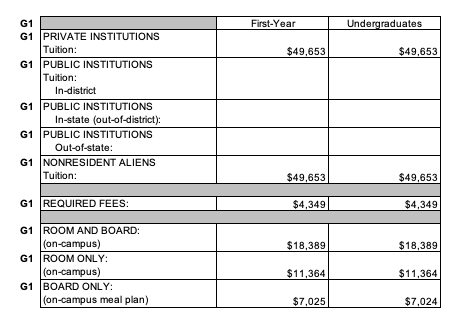

The Common Data Set (CDS) initiative is a collaborative effort among data providers in the higher education community and publishers as represented by the College Board, Peterson's, and U.S. News & World Report. The goal of this collaboration is to improve the quality and accuracy of information provided to all involved in a student's transition into higher education, as well as to reduce the reporting burden on data providers. The CDS is an excellent tool for breaking down quantitative data for a university. Categories like: How much funding goes toward international students? What is the breakdown of the student body population? How does a school rank, in order of importance, parts of the application? All this information and more can be found in this document. Here are some sections of the CDS we find to be useful in the college/university research process:

Section B

This section breaks down general enrollment by categories such as cohort, gender, and racial/ethinic identity. If diversity is important to your college experience, this will be a useful section for you!

Section G

Reminder: Section G outlines the COA for the university. Understanding how and where the money goes is an important part of your research.

Section H

In this section, you can examine the average financial aid awarded to international students by the college/university. Out of the H categories, H6 is the most important: Aid to Undergraduate Degree-seeking Nonresident Aliens, also known more simply as: international students. Here you'll find the total number of international students receiving institutional financial aid, the average amount awarded, and the school's total budget. If the average financial aid award is significantly lower than your EFC, then this school is likely not a fit for you. Why? Because, even if you are accepted, you may end with a gap; gapping is when a college offers a financial aid award that does not meet a student's full financial need.

Let's review: From this Common Data Set, we can gather the following details about the school:

-

Average need-based aid package to international students is $64,000 USD.

-

Total institutional aid awarded to international students is approximately $38,000,000 USD.

-

International students make up approximately 13% of the student body

-

Total number of students receiving aid is 590, which likely means about 147 students per class are receiving some sort of aid. It can also be assumed that approximately the same number of incoming students are likely to receive a similar average financial-aid package.

-

Conclusion: This school will be extremely competitive for a high-need student.

Non-Traditional or Alternative Pathways to College

Who said U.S. colleges were the best options for you and that post-secondary pathways had to be direct college pathways? There are myriad non-traditional or alternative pathway possibilities available for students. These are amazing confidence-building, skill-building, money-saving choices for students who have found that the structures of traditional education are not for them, or for students who maybe just aren't ready to dive into the college experience yet. Choosing this path might seem daunting, but with careful planning, you can find a successful path that's your "best fit." Here are some alternatives you can pursue:

-

Geoswerve © your applications

-

Community college

-

Studying in one's own country for a first degree, then leaving for a second

-

Entrepreneurship projects

-

Vocational training

-

Gap year

-

Work force

Note: Geoswerve is a word coined by the Nepal Justice League counseling team. It means to geographically swerve applications to a country or location that may not be initially on one's radar. Typically refers to swerving to non-US universities. ©

Speaking of alternate pathways, here are a few hacks and tips for lesser-known ways to save some money:

-

Submit your SAT/ACT score in lieu of a proficiency test

-

Duolingo English Test, when accepted, instead of TOEFL/IELTS/Cambridge or others

-

Test Optional and Flexible Schools to avoid testing

-

Use Your Four ACT/SAT Free Score Reports to avoid paying to send your scores

-

Merit Award given automatically by universities

-

Local Resources such as churches, private companies, the Rotary Club or a Ministry of Education

How do I begin?

Visualizing the road ahead is helpful in preparing you for your goals. Planning for college is no different. We like to start with a calendar and/or timeline of some sort, especially when it comes to financing your education, since there are many deadlines and opportunities that may make getting a post-secondary education more affordable. Take some time to write out a timeline of what your college application season should look like, aligned with your school system. Below is an example to give you an idea of what you can create! Remember, the application season runs for about 12 months total (each university having its own preferred deadlines), from August to August. To apply, you must be receiving a high school diploma or equivalent within the timeframe. Note: If you have matriculated to college already, it is important to get in touch with an admission representative to understand how this may change your application status and potential financial package.

For a longer timeline guide outlining your junior and senior years, click here.

What Documents and Forms Should I Prepare to Find and Fill Out If Required?

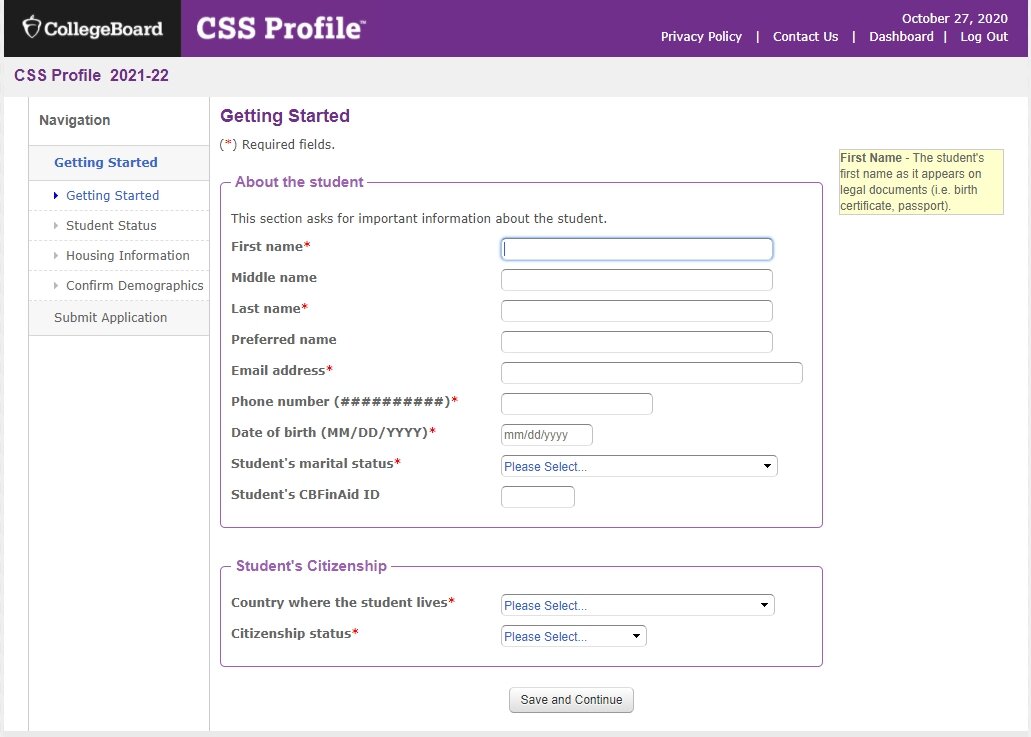

How to use the CSS Profile

The CSS Profile is a financial-aid application used to determine the need for institutional financial aid. Colleges use this application to:

-

See a larger picture of the family's finances

-

Understand the family's true financial need

-

Help award aid to students who truly need it

-

Distribute aid in an equitable manner

The CSS Profile is a very in-depth form, so your family may be expected to provide additional documents with the application (e.g., recently completed tax returns, other records of current income, records of untaxed income and benefits, assets, and bank statements). Your family will report their income from two years prior to the year you plan to attend college. Also, the CSS Profile requires financial information from both parents and their spouses. You can report in your home currency.

-

Create an account or log into your College Board account.

-

Select the correct application year.

-

Complete the application … and pay the fee.

-

Know what tax year information to prepare ahead of time (two years prior, "prior-prior year").

-

Have your documents ready and available when you start filling out the application.

Student Demographic Information

The questions in this section are about you, not your parents/guardians. These questions are extremely important in setting the CSS Profile up to work correctly. A mistake in this area can impact your whole application!

This section is a report of your parents/legal guardians—all of them: living parents, deceased parents, current stepparents, a parent's current partner, legal guardians, legal guardian's spouse. You can report up to four parents.

-

This question references where your parent(s)/legal guardian(s) currently reside(s). Do not report their country of birth or citizenship here.

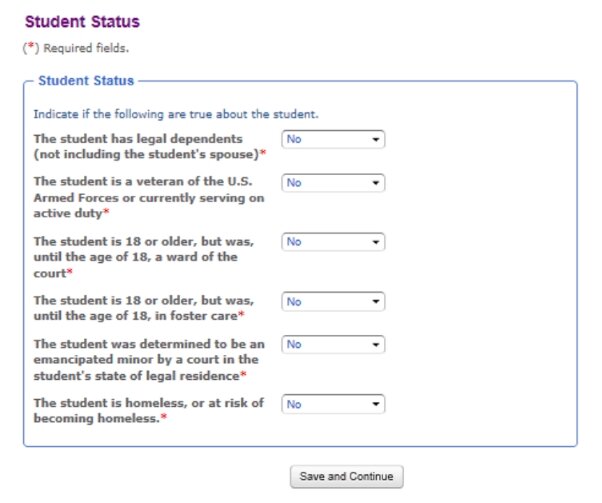

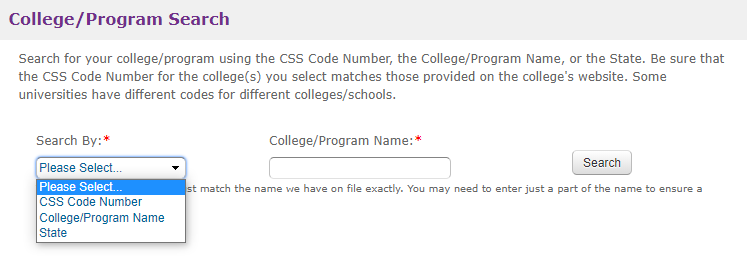

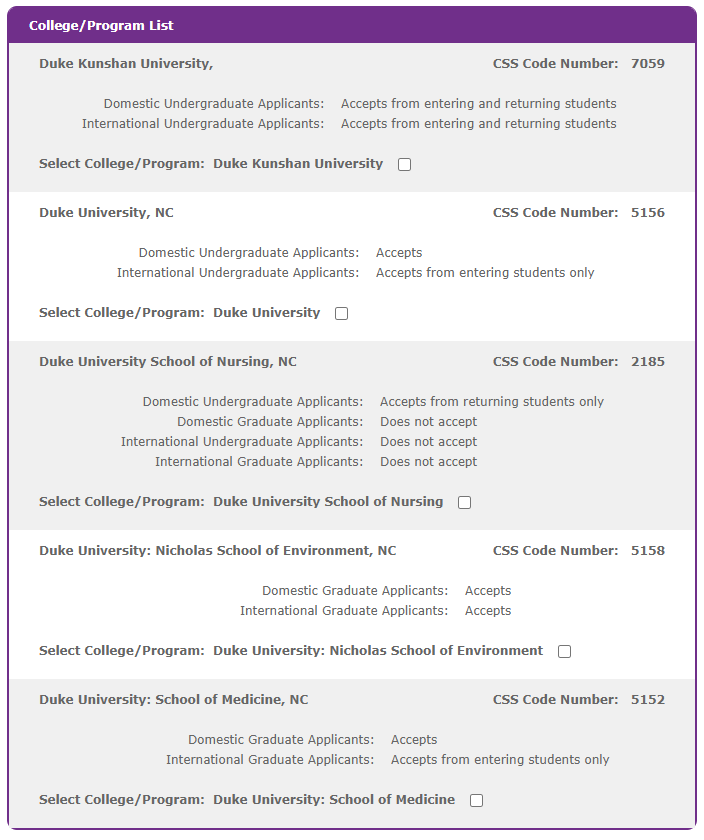

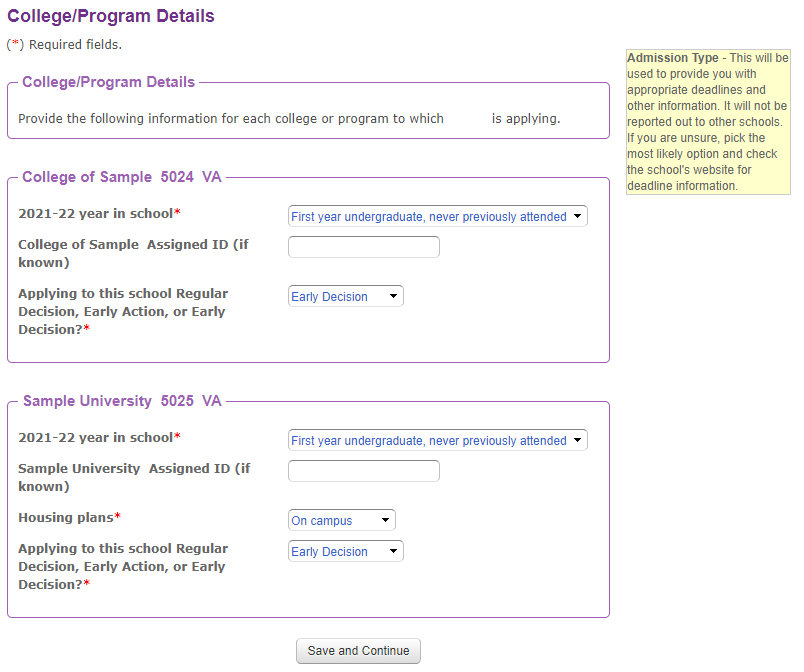

In this section, you'll find the colleges and universities to which you plan to apply to. If your school lists a CSS code, be sure to input it here!

Make sure to select the right college and program. For example, you should not select a graduate school, medical school, or law school. Selecting the wrong type of school could delay your application.

Can't find your college or university? Make sure your college accepts the CSS Profile from undergraduate applicants. Some institutions have their own application or use the ISFAA.

For many institutions, you must be a first-year student in order to apply for financial aid. You are considered a first-year student if you:

-

Earned college credits while in high school

-

Were enrolled in college courses while in high school

Income and Assets of Parents and Students

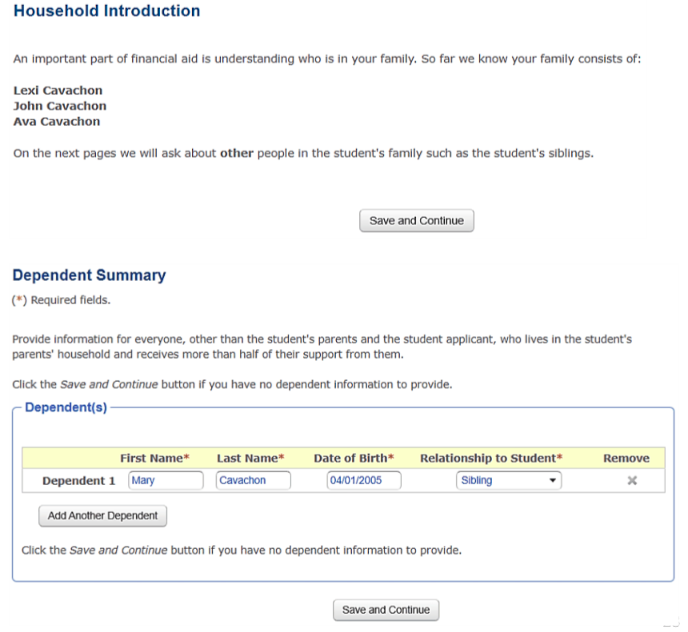

Household Information

Family members living in the same household, but who are supporting themselves financially, do not need to be reported.

Parent Expense Details

Expenses are factored in when calculating a student's EFC. In the CSS Profile, you will be prompted by questions to help determine your EFC. The profile also takes into consideration economic principles, such as cost of living, savings allowances, and tax allowances, in its calculations.

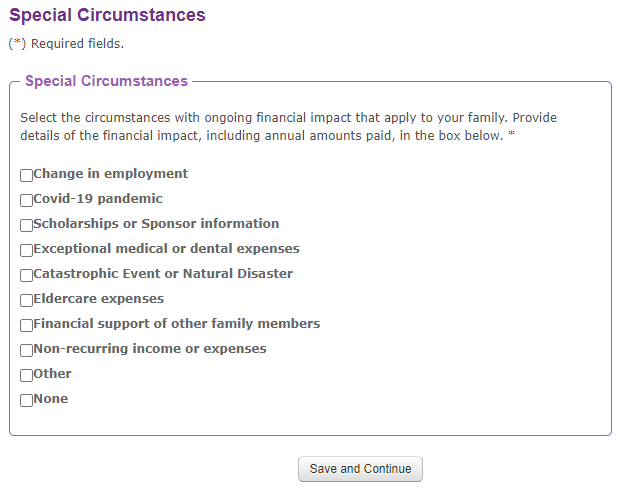

Supplemental Questions

Use this section, if you have a situation that is not clearly expressed through the financial-aid application—i.e., if a parent or guardian has a change in their employment or high medical expenses—this is the section to explain the circumstances.

CSS Profile for Parent Use

If you have a noncustodial parent (a parent who doesn't have guardianship/custody of the student applicant), they will need to complete a separate CSS Profile account. This is technically "a student account" with your parent's information. Similar to the student's CSS Profile application, the parent will complete the student sections of the application with the student's information and the parent sections with the respective parent's information.

-

Be sure to create this account using the parent's information, not the student's.

-

If you have no contact with your noncustodial parent, you can request Non-Custodial Waivers directly from the school.

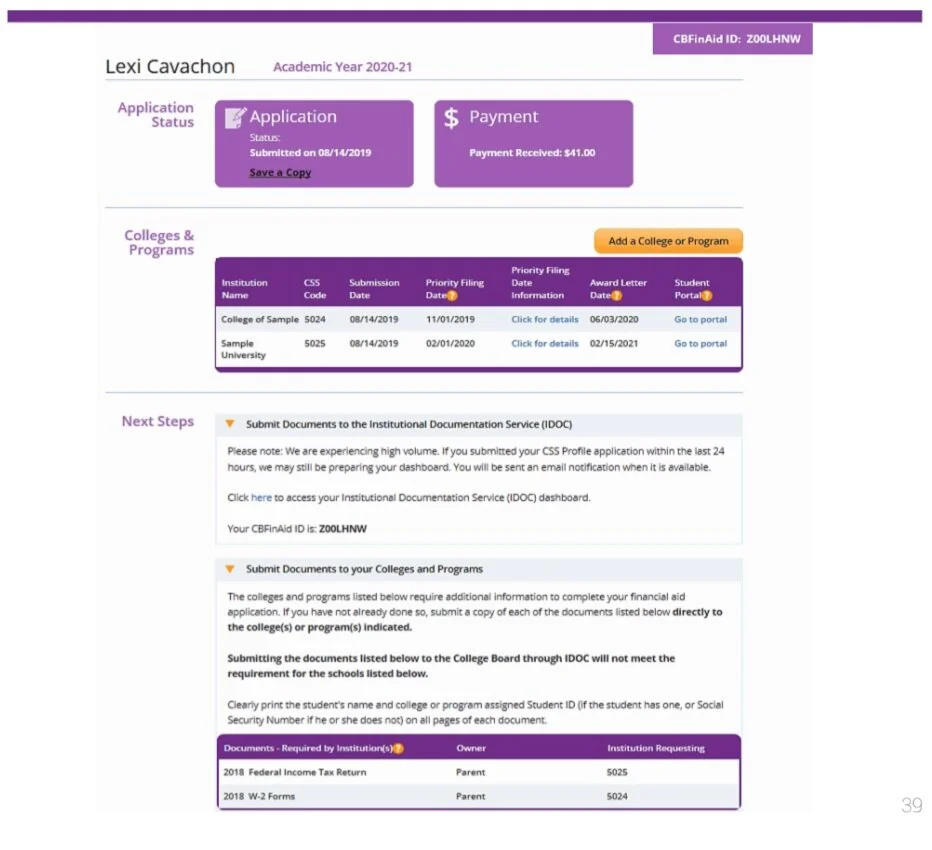

Almost Complete: CSS Profile Dashboard

Once you complete everything (listed before this), the CSS dashboard appears and lets you see the status of your applications, payment receipts, deadlines, and college information/details. Unfortunately, there is no CSS Profile fee waiver available. The CSS Profile costs $25 USD to fill out and submit to one college, then $16 USD for each additional choice.

Missing the financial aid deadline means you will not qualify for any aid for your first year of school. To preempt this mistake, we highly recommend treating the college application deadline as the deadline for the financial-aid application.

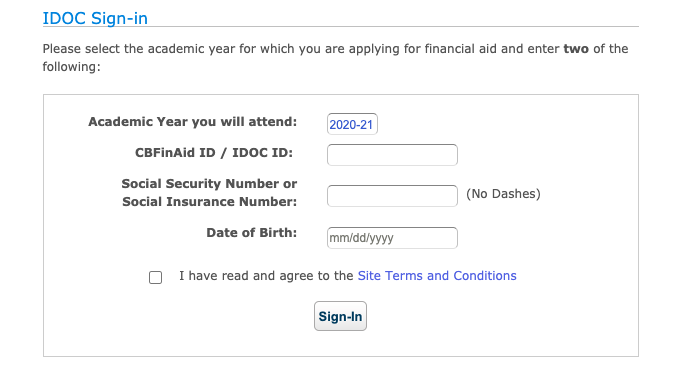

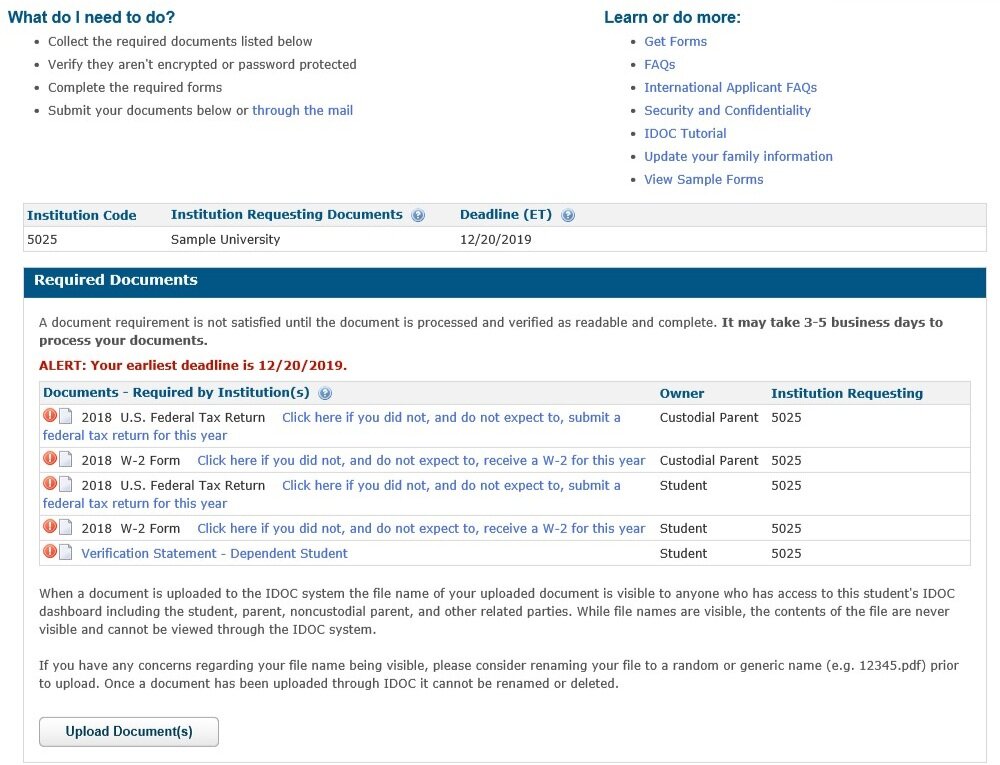

Once you submit your CSS Profile, you may need to send supporting documents to the school. This is where IDOC (Institutional Documentation Service) comes into play. Students who are required to submit documents will receive an email from the College Board with login details to IDOC provided. In IDOC, students will be asked to upload documents such as tax forms, bank statements, and/or other financial aid documents for you and your parents. Be sure to submit your documents by the set deadline!

You will get an email from the College Board notifying you if you need to submit documents through IDOC. Until then, you cannot sign in.

Forms and Status of Submitted Documents

Institution-specific documents are found in the Get Forms link in IDOC. Most forms require a handwritten signature, which means the student should print and sign the form, scan, and then upload it to IDOC. Once a document is uploaded, you can find it in the Uploaded Documents section. Processing may take 3-5 days, so be patient.

How to Use the International Student Financial Aid Form (ISFAA)

The ISFAA is a financial-aid application used to determine the need for institutional financial aid. Colleges use this application to:

-

Understand the family's financial need

-

Help award aid to students

This is a free, paper-based application available for download on the respective school's website. Students are required to convert income and asset information into U.S. dollars (USD) and provide additional documents with the application. For example, recently completed tax returns, records of current income, records of untaxed income and benefits, assets, and bank statements could be required. Your family will report their income from one year prior to the year you plan to attend college with this application.

Parent/Legal Guardian Information

For the ISFAA, "parents refers to custodial parents, or the parent or parents with whom you live." In this section is a chart to report all your family members (except for yourself) dependent on your parents' income.

This section covers your family's financial information. Remember, for the ISFAA, you must report this data in USD. Any income your family is receiving goes here.

You must report all income in your financial-aid applications. Income includes:

-

Money earned from work (wages)

-

Self-employment income

-

Business income

-

Income from investments, dividends or retirement payments

Income plays an important factor in determining EFC.

Most money and property owned by your family will be counted as an asset. In this section, write the value of assets and any debt counted against the asset at the time you complete this application.

Assets include:

-

Savings

-

Land owned

-

Business equity

-

Home equity

Families are not expected to contribute all their assets toward their child's education. On the contrary, only a reasonable percentage of assets reported on your financial aid applications will be taken into account when determining EFC.

In many cases, expenses are factored in when calculating a student's EFC. Why? Family expenses and other commitments impact your family's actual available income. You must use specific amounts for each category listed (if applicable). If you do not know the exact amounts, provide an estimate.

In this section, identify the amount of money you and your family are able to contribute toward your education. You should never leave this section blank or put "zero" in each category if you are able to contribute. If you can contribute only $500 USD per year toward your education expenses, then list it.

These amounts may not be what you will be responsible for.

Schools might compare their calculated EFC to your listed "expected support" to determine an appropriate contribution for your family.

Families should include information in this if they have experienced unexpected and uncontrollable changes in their financial circumstances. Examples of these changes include:

• Loss or change in employment

• Loss due to recent natural disaster

• High medical expenses

• Unusual family expenses (e.g., eldercare)

Changes to your Financial Aid Application

In both applications, there is a section for families to explain any special circumstances universities should consider when reviewing their application. In some cases, financial situations might change while the application is being processed. Or maybe you found an error in your application after you submitted. Always inform the colleges of any special circumstance and errors to give yourself the best chance at receiving aid. Because funding is limited, it is important you update the college with these changes as soon as possible.

You're in—now what? How do you choose your best "financial" fit?

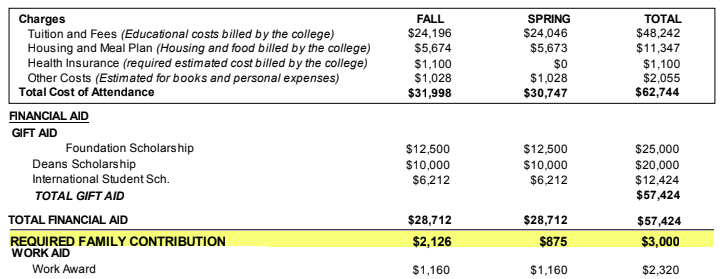

It's important to review your financial aid packages carefully in order to understand everything you're responsible for. You might get a full ride, which covers all billable expenses, leaving you responsible for expenses such as health care, books, and transportation costs. Look over your package line by line to see what's included. The package may also include merit loans, which have academic minimums you must maintain, or loans you must repay after graduation. Let's look at a few packages to understand how different universities distribute their funding.

A Brief Guide to Analyzing Your Financial Aid Award Letters

This award letter is very clear and breaks down the COA and award for the student. College C has awarded three scholarships: a Davis Foundation Scholarship, the International Student Scholarship, and the Dean's Scholarship, giving this student a total of $57,424 USD in gift aid. There are no loans in this aid package. The student's work study is labeled "work aid" and totals $2,320 USD.

-

Putting your packages side by side in a chart really helps you compare what each school covers and what you are responsible for.

-

If you're not clear about what's included in your package, reach out to your college counselor or admission counselor for help!

Need more help?

For a slightly longer guide to reading your Financial Aid Award Letters, including a downloadable template, click here .

STILL NEED SOME MORE MONEY? HOW TO THOUGHTFULLY APPEAL A FINANCIAL AID OFFER

While not guaranteed, it is sometimes possible to make a "Financial Aid Appeal" to a university and have your financial situation reexamined. Financial appeals should be made to the one school, if given the right financial aid package, you would definitely attend. Your appeal not only should ask the university for flexibility, but also show your flexibility regarding your family's contribution.

How likely is it that colleges and universities consider an appeal? It usually depends on whether there are still funds remaining in their financial aid budget . This process will differ depending on the institution, so check the school's website or contact the financial aid office about the process for appeal.

What is considered a reason for appeal?

-

Errors in original information

-

Recent change in employment or income

-

Change/increase in support of other family member(s)

-

Exceptional medical expense

What's often not considered a reason for appeal?

-

Wanting more financial aid, not simply needing it

-

Using another institution's financial aid offer to try and negotiate

-

Fluctuations in exchange rates

When you're appealing your financial-aid package, you should be ready to show why the original package did not meet your family's demonstrated need. This can be done by submitting supporting documents and explaining the situation in writing. To show your commitment to making this work, we recommend that you try to meet the school "half way." A sample letter can be found in the section below.

Want to see an example?

For a longer guide on how to write a letter of appeal, including examples, click here.

Gratitude and Grace

As you approach the end of the college application season, don't forget about grace and gratitude. Whoever had a hand in getting you to this finish line, show them your appreciation and thanks. Remember to take a moment to share your news (good or bad) with the people who wrote letters for you, who sat up late with you as you barely made that deadline, or who had a kind word for you when things felt complicated. With your mind and heart open, remember that a tactful show of appreciation can come in the form of a handwritten note, personalized email, a video chat, or even a face-to-face. Whatever you decide to do, do it with intention.

Here is a sample letter from students to inspire you on your path to gratitude.

Dear TEACHER/COORDINATOR/COUNSELOR:

I hope this email finds you well. With my last milestone as a high school student finally over, I wanted to thank you personally for your support.

Thank you for not only helping me with so many personal matters, such as figuring out what I want to be in the future, but reminding me of who I am during the process. While I am still not sure where exactly I would like to be in a couple of years, it is my firm belief that I hope to be a voice for those less privileged than I am.

I am grateful I had such powerful educators such as yourself to support me throughout.

Thank you again for everything. I hope to keep in touch with you.

Sincerely,

STUDENT

Glossary of Terms

Agent: A company (agency) or individual (agent) contracted and paid by high schools and universities in other countries to advise and recruit students to their institutions.

Apostille: A legalized document. The Apostille Treaty is an international treaty drafted by the Hague Conference on Private International Law and signed on October 5, 1961. The Hague is a city in the Netherlands and is the location of the International Court of Justice. This treaty defines the ways through which a document issued in one of the countries that signed the treaty or convention can be certified for legal purposes in all the other countries that signed the treaty. In many countries, the document's notarization is the legal evidence of its authenticity. For the signatories of the Hague Convention, certification by the country's approved state or national office authenticates the notarized documents. Notarized official transcripts and/or notarized diplomas are often required by other countries to verify the degree's authenticity.

Billable (Direct) Costs: This is basically an expense that an institution has incurred on the student's behalf for performing work, offering services, or providing supplies. This is the bill the student or family will receive from an institution.

Colleges: These are often categorized as smaller institutions that emphasize undergraduate education in a broad range of academic areas, such as a liberal arts college.

Cost of Attendance (COA): This is an estimate of your educational expenses for a given period of enrollment. The COA is the cornerstone of establishing your financial need, and it sets a limit on the total aid you may receive. It consists of both direct costs, or those paid directly to the institution, and indirect costs, or those that are incidental to your attendance. Your Cost of Attendance should not be confused with your Student Account Statement (bill)*.

Bureau of Educational and Cultural Affairs: This bureau of the U.S. Department of State works to inform both U.S. students wishing to study abroad and international students wishing to go abroad for cultural, educational, or professional exchanges.

Certificate of Finances: This form, issued by College Board, helps colleges and universities obtain accurate financial-related information about international applicants seeking to study in the United States. Because financial verification is required before a Certificate of Eligibility (Form I-20) can be offered to an international student, this form facilitates that end goal.

College Scholarship Service (CSS) Profile: This online service provided by College Board allows students, including international students, to apply for financial aid. College Board member schools have access to the information once submitted, and students must pay a small fee to create a CSS Profile. More detailed than FAFSA and available earlier, the CSS Profile is a good option for Early Action and Early Decision applicants, as it gives the schools they are applying to a better idea of their financial aid needs early on.

Community colleges: Also known as junior college, technical or city colleges, these schools are typically two-year public institutions offering certificates, diplomas, and associate's degrees. Once completing an associate's degree, a student can transfer to a 4-year institution for a bachelor's degree.

Cooperative education: A "co-op" combines classroom-based education with practical work experience, providing academic credit for structured job experience. Co-ops are focused on training students for a career in their chosen major (e.g., IT, engineering, etc.). Universities often partner with employers in various industries for internships, which are likely paying jobs (i.e., University of Toronto in Canada and University of Cincinnati).

Curricular Practical Training (CPT): This is full-time or part-time employment that is an integral part of an established curriculum, such as work study, internship, practicum, etc. CPT must relate to a student's major and be part of their program of study. CPT can be obtained only prior to the completion of the student's degree, and the student must already have a job offer when they apply for CPT.

Department of Homeland Security (DHS): This U.S. governmental agency manages SEVP and Study in the States, both of which provide resources to prospective international students.

Designated School Official (DSO): All SEVP-certified schools are required to have one DSO. These individuals are responsible for communicating regularly with SEVP. This individual is typically an international student's greatest resource on campus when it comes to the visa process, maintaining student status, and following proper regulations and guidelines once in the United States.

DS-160: The DS-160 Form is submitted electronically, via the Internet, to the Department of State website. The information entered on the DS-160 is used by Consular Officers to process the visa application. A combination of the information from the form and personal interview will determine an applicant's eligibility for a nonimmigrant visa.

DS-2019: The Certificate of Eligibility for Exchange Visitor Status is issued to potential J-1 visa applicants; the form is completely unique to each student as it requires its own SEVIS ID number.

EducationUSA: This U.S. Department of State network promotes U.S. higher education to international students by offering guidance about opportunities to study abroad in their home countries. EducationUSA comprises over 400 international student advising centers in more than 170 countries.

F-1: This is the student visa form, issued to international students who are attending an academic or English language program at a U.S. college or university. Students must maintain student status while studying with this visa, which usually means maintaining a full-time course load of a minimum number of credit hours.

General Certificate of Secondary Education (GCSE): This academically rigorous subject-specific test is generally taken by students in secondary education institutions in England, Wales, and Northern Ireland over a two-year period.

General Certificate of Education Advanced Level (A-Level): This curriculum program, completed with a school-leaving test, is administered in the United Kingdom, but it's also implemented and recognized in a number of other countries worldwide. The curriculum is split into two parts, studied over two years. The first part, Advanced Subsidiary Level (AS), is a qualification on its own. However, when the second part, the A2 Level, is completed as well, the two form a complete A Level qualification.

I-20: The Certificate of Eligibility for Nonimmigrant Student Status is issued to potential F-1 and M-1 visa applicants by the U.S. Department of Homeland Security. Students need the I-20 to apply for a nonimmigrant visa and/or to obtain entry to the United States, and they must pay the required international fees to the school they choose to attend.

I-94: This is the Arrival/Departure Record for foreign visitors. Customs officials will compile visitors' I-94 arrival/departure information automatically from their electronic travel records for air and sea ports of entry or via paper forms for land border ports of entry. Nonimmigrant visitors who need to access their I-94 number can go to the U.S. Customs and Border Protection website.

I-17: The Petition for Approval of School for Attendance by Nonimmigrant Student form is required to be completed and then certified by SEVP before any school in the United States can enroll nonimmigrant students.

Independent Educational Consultant: This is a professional hired and paid only by students and their parents for personalized advice on the university search, application, and admission processes.

Indirect Costs: These are all portions of the total cost of attendance except tuition and fees. This includes books and supplies, room and board, transportation, insurance, a small entertainment allowance, and other personal expenses.

International Baccalaureate (IB): The IB is an international educational foundation offering four programs (divided by age) for children aged 3-19. Its diploma program for ages 16-19 is recognized around the world as a respected, advanced course option for high school students.

International English Language Testing System (IELTS): This test assesses the English language proficiency of people who want to study or work in regions where English is the language of communication. This exam is administered face to face with an examiner and assesses test takers on their listening, reading, writing, and speaking skills. IELTS is accepted by more than 9,000 universities, schools, and organizations in over 145 countries.

J-1: This Exchange Visitor Visa is issued to individuals who are approved to participate in work- or study-based exchange visitor programs. Exchange visitors are expected to return to their home country upon completion of their program.

M-1: This student visa is issued to international students who are attending vocational or technical schools in the United States.

Merit-based financial aid: Also called merit scholarships or merit award, this financial aid is offered in recognition of student achievements, such as in academics, testing, athletics, arts, service, etc. Merit-based aid does not take into account the financial need of the student or family.

Michigan English Language Assessment Battery (MELAB): This standardized exam is for adult, intermediate to advanced non-native speakers of English. Test takers are evaluated for listening, reading, writing, and speaking skills. The written, listening, and grammar/vocabulary components are required. The speaking component, in which you speak with an examiner, may not be offered at every test site and is not automatically included in the test registration. Over 550 U.S. colleges and universities accept the MELAB.

Need-based financial aid: This type of college funding is available to low-income students. Rather than taking your grades or talents into account, these scholarships, grants, and student loans are offered based on your family's income, along with other financial factors.

Optional Practical Training (OPT): Optional Practical Training must relate to a student's course of study/major and is typically completed after the end of their degree program. A student can apply for 12 months of OPT at the bachelor's level and another 12 months at the master's level.

Principal Designated School Official (PDSO): All SEVP-certified schools are required to have at least one Principal Designated School Official; this person serves as the main point of contact for SEVP.

Student and Exchange Visitor Information System (SEVIS): This web-based system was developed by the DHS to maintain information on SEVP-certified schools and the F and M visa students who study there. SEVIS also maintains information on the exchange visitor, program sponsors, and holders of J-1 visa, which are managed through the U.S. Department of State. Through SEVIS, essential I-20 forms are issued to students looking to obtain F or M status visas, student records are transferred to other institutions, and the certification of educational institutions as SEVP-certified are approved and monitored.

Student and Exchange Visitor Program (SEVP): The Student and Exchange Visitor Program (SEVP) is a part of the National Security Investigations Division. It connects government organizations that have an interest in information on nonimmigrants whose primary reason for coming to the United States is to be students.

Test of English as a Foreign Language (TOEFL): This exam is taken to measure a student's English language proficiency. The exam evaluates test takers in four ways: reading, listening, speaking, and writing. This test can be taken over the internet or in paper format and is recognized by over 9,000 colleges, universities, and agencies in over 130 countries.

U.S. Department of State: This U.S. federal government agency sets forth and maintains the foreign policy of the United States, especially in negotiations with foreign governments and international organizations.

Universities: These schools are often larger institutions offering a variety of undergraduate and master's/doctoral degree programs. Universities can also have divisions within such as the College of Liberal Arts or College of Science.

U.S. Customs and Border Protection (CBP): This U.S. federal government agency provides comprehensive border management and control by combining customs, immigration, border security, and agricultural protection all in one department. Students will deal with employees of CBP when they enter and depart the United States.

Do You Have to Pay Back Financial Aid?

Source: https://www.collegeessayguy.com/blog/financial-aid-international-students

0 Response to "Do You Have to Pay Back Financial Aid?"

Post a Comment